Singapore’s fintech startup, EduFi, has achieved a significant milestone by raising $6.1 million in a pre-seed funding round. This substantial investment was led by Zayn VC and supported by Palm Drive Capital, Deem Ventures, Q Business, and several angel investors. EduFi, leveraging artificial intelligence, has developed a ‘study now, pay later’ (SNPL) lending platform and mobile app, designed to alleviate financial barriers for students in pursuit of education.

Addressing Education Finance in Pakistan

EduFi’s platform initially focuses on Pakistan, where there is an absence of dedicated student loan products. In this region, students often have to rely on high-interest personal loans due to this gap. EduFi’s innovative platform targets two significant issues in Pakistan: the high poverty levels and the low literacy rates. The company aims to provide affordable education opportunities, bridging the gap from high school to university admission. This strategic move comes in response to the educational spending in Pakistan, where a considerable portion of the population lacks access to basic financial services.

Leadership with a Vision

Aleena Nadeem, the founder and CEO of EduFi, an MIT alumna with experience at Goldman Sachs and Ventura Capital, was inspired to address these educational barriers during her tenure at the Progressive Education Network. Her experience in providing free education to underprivileged children in Pakistan shaped the vision behind EduFi.

Bridging Educational Gaps

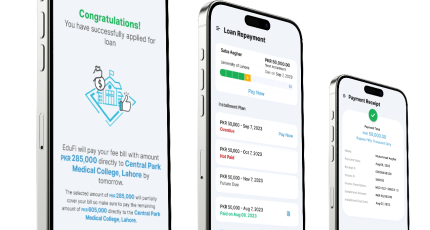

EduFi is focused on easing the financial burden for students during the critical transition period between high school graduation and university enrollment. The startup has formed partnerships with 15 universities in Pakistan, making its platform accessible to around 200,000 students. EduFi’s application process requires disclosure of financial information, ensuring a smooth and efficient loan disbursement process that significantly outpaces traditional banking methods.

A Step Toward Financial Inclusion

EduFi’s goal extends beyond lending; it aims to disrupt traditional banking norms by offering a digital lending app with user-friendly processes and flexible loan terms. The ultimate objective is to alleviate the financial strain of educational expenses for families, particularly in Pakistan, where a significant portion of income is dedicated to education. The funds raised will enable EduFi to expand its reach, optimize its platform, and introduce new fintech products, marking a significant step toward financial inclusion for underprivileged families.

Also learn about Singapore FinTech Festival 2023.